One-click RWA Leverage

Put your idle RWAs to work and unlock their capital efficiency

In-house RWAs

Invest in properties of major metropolitan areas.

Earn the 5% risk-adjusted yield with potential for capital appreciation.

Third-party RWAs

Deposit and loop T-bills, equities, gold, and earn competitive yields.

Start earning today.

ETFs

REITs

Treasuries

Gold

In-house property price feeds

Our price feeds price real estate accurately and frequently, allowing properties to act as collateral at scale.

Property indexes track median real estate prices in major cities - explore them for yourself below!

Frequently Asked Questions

Zona is a RWA-focused lending platform, allowing over $15B in RWA TVL to unlock onchain utility and capital efficiency. No longer does your tokenized real estate need to sit idle in your wallet, you can deposit it as collateral in Zona and take out the first onchain mortgage.

It's increasingly clear that RWAs have become one of the standout narratives this cycle. According to DefiLlama, over $15B in RWAs have been onboarded within the last 3 years alone. However, the vast majority of these assets remain as idle capital in user wallets, unable to unlock any utility.

Take real estate as an example - with an offchain house, you can always go to a bank, take out 50% of the value as a loan, and use that money elsewhere. However, this is currently not possible for tokenized real estate due to the lack of supporting infrastructure, which severely limits the scalability of the entire sector.

Zona consists of two core products:

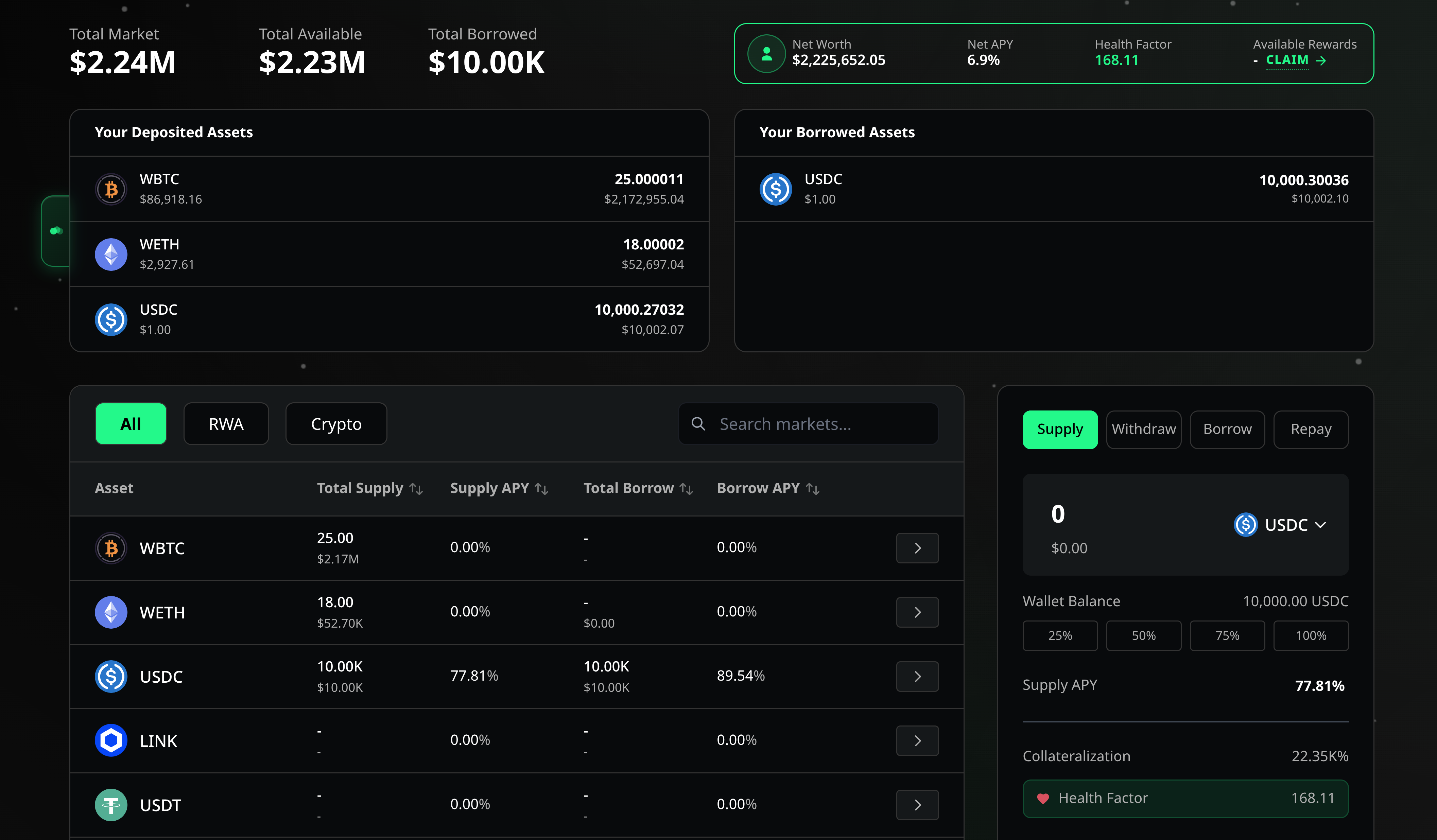

(1) ZonaLend: Our lending platform specialized in supporting both in-house and third-party RWAs. We allow listed RWAs that have passed our due diligence to be approved as collateral, thereby unlocking further capital efficiency. For onchain real estate in particular, our proprietary price indexes track property prices changes of different cities, allowing collateralized real estate to be valued accurately and frequently. As a result, our purpose-built real estate oracles unlock an exciting product for the first time - the onchain mortgage, revolutionizing property-backed lending.

(2) Zona Parkhub: Our in-house tokenized real estate, starting with parking spaces. Although often overlooked, parking spaces in major cities provide some of the best risk-adjusted yield on the market due to favorable demand-supply dynamics, ranging from 5-10% depending on the location. Note that this is from rental income alone, and does not factor in ever-rising property prices yet!

Zona aims to support all RWA asset types, including but not limited to: treasury bills, money market funds, equities, commodities, foreign currencies, ETFs, and more. The first asset to be supported is the Zona Parkhub, which offers a curated portfolio of tokenized parking spaces located in prime locations of Hong Kong, offering users with the best risk-adjusted returns in the market.

Join our discord and talk with us in #general. For private discussions, please open a ticket in #tickets